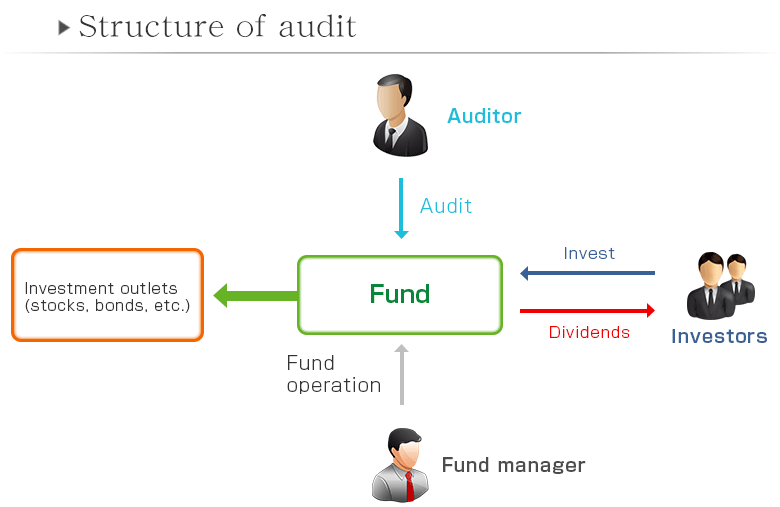

Fund auditing

Fund auditing is when a party with a financial interest in a fund, particularly investors, in order that they can trust the operating results of the fund, have the financial information verified by an independent third party external auditor.

Multiple schemes are operated by a fund, as shown in the chart below, and whether or not an audit is legally required will be different for each one.

Multiple schemes are operated by a fund, as shown in the chart below, and whether or not an audit is legally required will be different for each one.

| Principal Schemes | General Characteristics | Requirement for Statutory Audit | Examples of Investments |

|---|---|---|---|

| Investment Limited Partnerships (LPS) | Composed of unlimited liability partners and limited liability partners | ◯ | Venture Capital Contents Fund |

| Partnerships Based on the Civil Code | Partners all have unlimited liability (There are some cases of adjusted liability between partners) | – | Venture Capital |

| Silent Partnerships (TK) | By partnering with a limited company, which provides its investors with a high degree of anonymity, it becomes easy to get a bank loan | – | Fund Real Estate (beneficial interest) |

| Specified Purpose Companies (SPC) | There are limits on additional acquisition and disposal of assets for which multiple means of raising funds (investment, securities, and loans) exist. | ○ (※) | Real EstateSecurities |

| Real Estate Investment Trust (REIT) | Minimum capitalization at which real estate holdings can be substituted is 100 million yen. | ○ | J-REIT |

| Offshore Funds (Cayman SPC’s etc.) | Conformity with the laws and regulations of that country | – | Stocks, Bonds, Real Estate, etc. |

※The only securities that may be issued are specified corporate bonds, and in the case where the total amount specified corporate bonds and loans for a specified purpose is less than 20 billion yen, a statutory fund audit is not required.

Diagram of fund audit

Fund audits are conducted by a statutory auditor independent from the fund, according to the structure shown in the diagram below. The structure is as shown below.